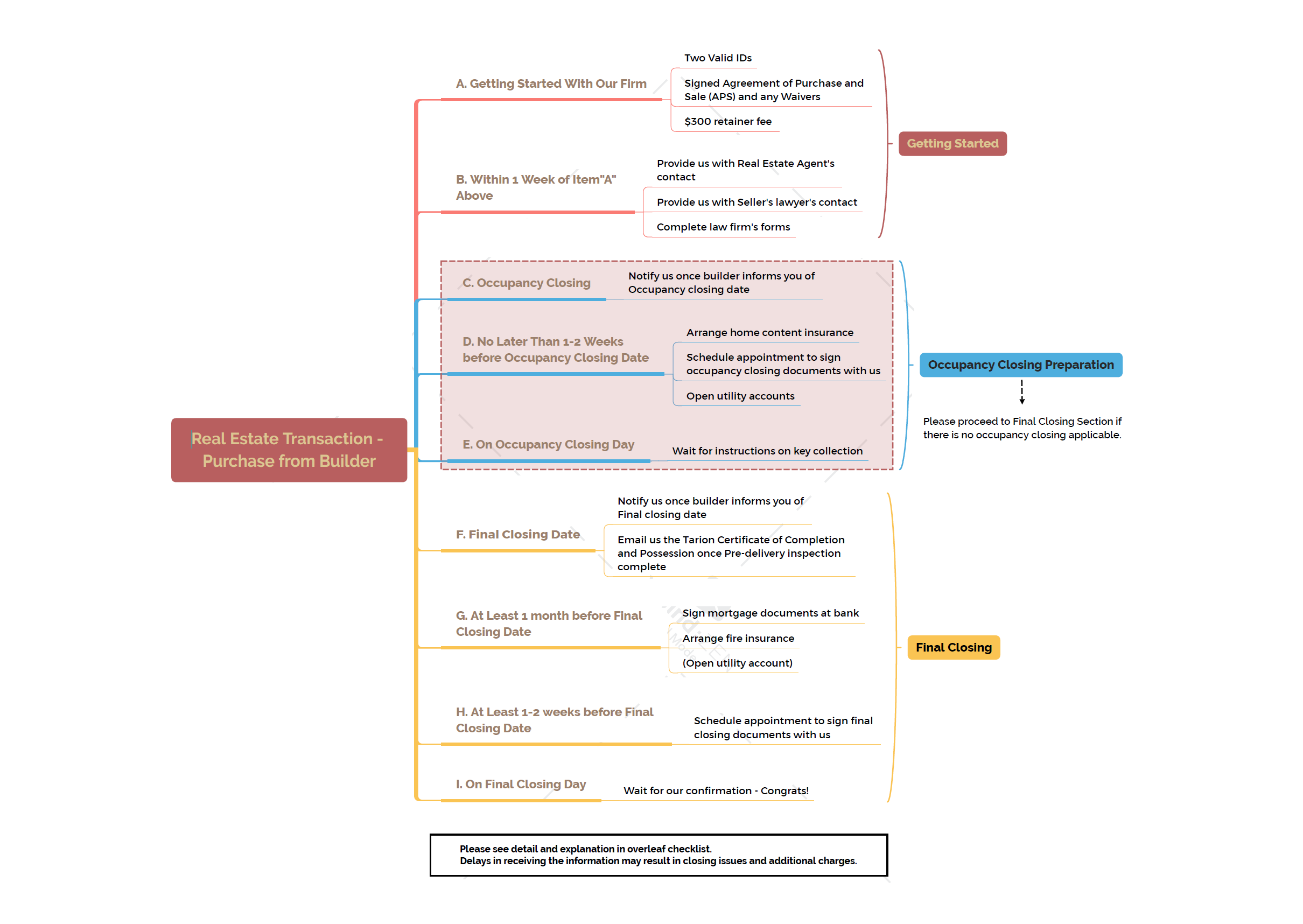

Purchase of Residential Property from Builder Client Kit

Step by Step Guide to finalize your Purchase with Landmark Law

In order to commence our services promptly and facilitate a smooth transaction, please provide the following by the stated timelines. Delays in receiving the information may result in closing issues and additional charges may apply. Thank you for your cooperation!

Fee Quotes

Please refer to our Cost Calculator [Click Here] for the fee quotes or view it immediately below from the embedded cost calculator:

STEP 1: Offer & Getting Started (Immediately)

Please immediately provide Landmark Law with:

[If anything need to be submitted by email to Landmark Law, please email info@landmarklaw.ca]

Click Here to send us an Email!!!

i. Email Signed Purchase and Sale Agreement with any Amendments.

ii. Email Two valid ID's for each title holder

(e.g. Canadian Driver's License, Credit Card, Passport/PR; Health Card not accepted.).

Please make sure to submit a clear "front-side" and "back-side" scan or photocopy of your two pieces of identification.

iii. Remit $300 Retainer payable to "Landmark Law Professional Corporation, in Trust" or e-transfer to winnie@landmarklaw.ca

If by e-transfer, please provide Landmark Law with the e-transfer secret password.

iv. Complete the Landmark Law's Standard/Joint Retainer

PDF Retainer to complete by hand and scanned back: PDF Standard/Joint Retainer [Click Here]

v. Complete Form 1A - Landmark Law's Verification of Identity Form

[Option to either complete online or by PDF]

[To change language between English, Traditional Chinese and Simplified Chinese, you may select them respectively from the drop down menu on the top right corner of the Form.]

Online Form to complete online: Online Form 1A [Click Here] or immediately above from the embedded Form

PDF Form to complete by hand and scanned back: PDF Form 1A [Click Here]

vi. Complete Form 3B – Landmark Law’s Purchase of Residential Property from Builder Questionnaire

[Option to either complete online or by PDF]

[To change language between English, Traditional Chinese and Simplified Chinese, you may select them respectively from the drop down menu on the top right corner of the Form.]

Online Form to complete online: Online Form 3B [Click Here] or immediately above from the embedded Form

PDF Form to complete by hand and scanned back: PDF Form 3B [Click Here]

Note: If there are any missing or incomplete information please submit them as soon as they are available to Landmark Law.

If there is an Occupancy Closing involved, there will be additional work and requirements from the builder’s lawyer. Please provide our firm with the following:

i. additional fee of $495+HST for the occupancy closing [without having seen the builder’s lawyers instructions].

Builders also often request the following from purchasers:

i. occupancy/tenant’s liability insurance;

ii. mortgage pre-approval; and

iii. post dated cheques for up to 12 months (please ensure you have enough cheques).

STEP 2: Closing Preparations

Please provide or confirm the following to/with Landmark Law immediately when you are notified by the Builder for Occupancy Closing (not all but most purchases from Builder have occupancy closing) or Final Closing of your purchase:

i. Signed mortgage documents with the lender (i.e., bank) and obtain the lender's "Address for Service" (their service address)

ii. Arrange for fire/home/content insurance and inform the insurance broker of the full legal entity name of your lender (designate them as the first loss payee) and their "Address for Service".

Please provide Landmark Law with a copy of the insurance policy

[For freehold purchases only: if there is no mortgage, fire/home insurance is not mandatory but recommended]

iii. For Final Closing, provide the Tarion Certificate of Completion and Possession to Landmark Law once the Pre-delivery Inspection is complete.

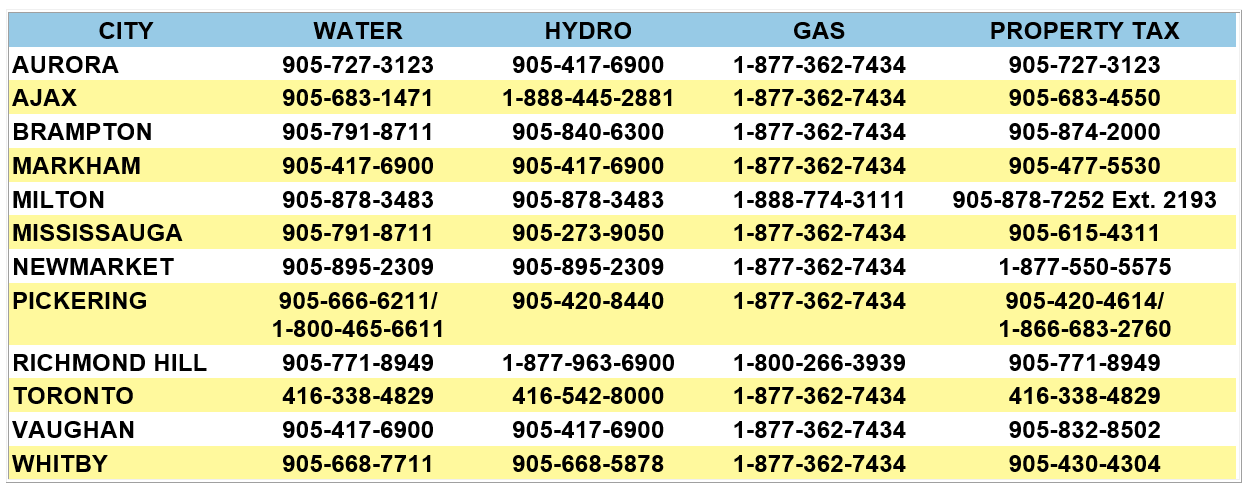

iv. Contact utility companies to open utility accounts (if applicable)

Due to privacy policies and per our client kit, clients must contact the utility providers directly to open/close their accounts.

Please arrange these at your earliest convenience (well in advance of before closing) to ensure smooth transition and in case the provider requires any follow up materials.

For your convenience, below are some telephone numbers for Greater Toronto Area. Your agent may be able to confirm exact service provider in the area and some providers may allow you to open/close accounts on their website.

***Please note that if there is a hot water tank, furnace or other equipment rental included in the agreement of purchase and sale, please inform us as soon as possible so that we can notify the other side solicitor. The purchaser will have to sign a form to take over the rental.

v. Inform Landmark Law of any travel plans you may have before the Closing Date of your purchase

vii. Order Status Certificate from the Condominium Corporation and provide it to Landmark Law if your purchase involves a condominium or a real property that is registered with a Condominium Plan.

viii. Make sure to book the moving elevator if your purchase is a condominium with elevators.

ix. Review the following information on Title Insurance:

Title insurance is used as standard real estate industry practice and is typically required by the mortgage lender. Our firm will be ordering this on your behalf to complete the transaction as set out in our cost calculator.

It is a substitute for independently searching/contacting various government organizations for claims against the property that might not be captured in standard searches. Such non-standard searches are costlier and more time-consuming than title insurance and may not necessarily be conclusive. Typically, responses from municipalities were qualified to exclude errors and omissions and therefore may not have been very reliable in any event. If you have no title insurance and the municipality makes an error in its response, you would still have been left with the cost of correcting the noncompliance.

The industry created title insurance to effectively and affordably protect title for new owners. Subject to certain exclusions, the insurance will cover the cost of remediation. Title insurance typically protects against losses arising from issues such as:

- Another party claiming an interest in your property

- Title defects caused by forged documents, false impersonations or other frauds

- Contravention of zoning bylaws

- Outstanding work orders

- Existing liens against the property

- Encroachments onto or from adjoining properties

- Errors in surveys and public documents

Please refer to the following information regarding title insurance:

Title Insurance Article [Click Here]

Furthermore, these YouTube videos below explain what Title Insurance is and why it is important:

x. If your Mortgage Commitment from the lender has liability account pay-downs or credit limit reductions:

For liability account pay-downs - Please continuously provide updated statements and screenshots of your liability accounts for the accurate amount of pay-down up till the day of closing

For liability account credit limit reductions - Please provide statements, confirmations and screenshots of your liability account's updated credit limit.

xi. If your Mortgage Commitment from the lender has liability account payouts and closure of the same:

Please note as Solicitors we are unable to accept such undertaking given that liability account closure is not in the lawyer's control. Consequently, Landmark Law will not take on such real estate transactions. You will have to contact your lender or broker to advise them of the situation and request for the necessary amendments (i.e., removing any condition requiring solicitor's undertaking to effect liability account closures). Once amended, please provide the amended copy for our processing.

STEP 3: In-Person Signing With Landmark Law

i. Prepare and remit closing funds, if any to Landmark Law

ii. Schedule your in-person signing appointment (Occupancy Closing or Final Closing) with Landmark Law

[Book the in-person appointment date to be roughly a week before your Occupancy Closing Date or Final Closing Date]

Book your Appointment: Booking Scheduler [Click Here] or immediately above from the embedded booking calendar

iii. Signing Appointment Preparations:

[Landmark Law will not be able to amend the Documents during the signing meeting as such the final version must be confirmed in advance of the signing appointment]

- Please bring originals of your previously e-mailed identification (2 valid IDs per person) to the in-person meeting for our inspection.

- Please wear a mask and bring your own pens to reduce exposure and spread of Covid-19.

STEP 4: Closing (Occupancy Closing or Final Closing)

i. On Closing Date (Occupancy Closing or Final Closing) - Wait for Updates from Landmark Law to collect your Keys - CONGRATULATIONS!!!

ii. For Condominium Purchases, remember to visit the property management's office to complete new owner forms.

iii. Landmark Law will inform and request the city's property tax department to update the new owners information for future tax bills.

iv. Landmark Law's Final Report will be provided to you in 4 - 6 weeks time.

v. If you were happy with our service, we would appreciate a 5-Star Google Review and "like" on Facebook/LandmarkLawPC. Thank you again for choosing and believing in Landmark Law!

Questions

If you have any questions please email info@landmarklaw.ca Click Here to send us an Email!!!Summary Flowchart:

Purchase of Residential Property from Builder