Non-Resident Speculation Tax (NRST) - Objecting to or Appealing the Decision of the Ministry of Finance

Unlock Your NRST Rebate and Overcome Objections with Our Skilled Legal Assistance

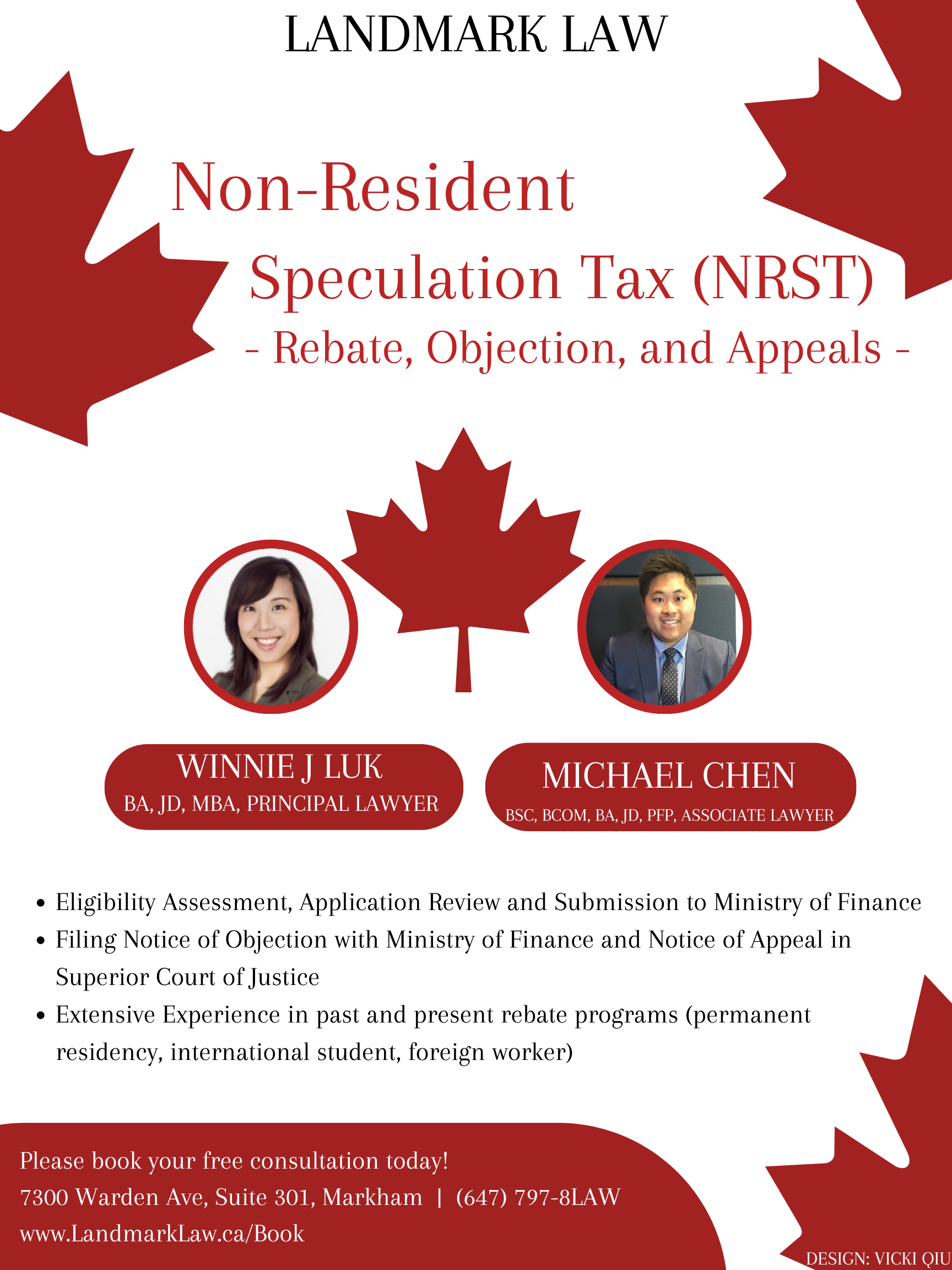

Navigating the complex landscape of Non-Resident Speculation Tax (NRST) can be challenging, but at Landmark Law, we have the expertise to help you secure your NRST rebate and overcome objections. Our dedicated team of legal professionals specializes in NRST matters, ensuring that you receive the best guidance and representation throughout the process.

NRST Rebate Services: Maximize Your Tax Benefits

If you're a non-resident of Ontario or a foreign investor who has paid NRST, you may be eligible for a rebate. Our skilled lawyers are well-versed in the intricacies of NRST legislation and the rebate application process. We will meticulously review your circumstances, assess your eligibility, and work tirelessly to maximize your tax benefits by pursuing the NRST rebate you deserve.

Overcoming NRST Objections: Protecting Your Interests

In some cases, the Ontario Ministry of Finance may raise objections to your NRST rebate application. These objections can be complex and require comprehensive legal knowledge to effectively address. Our experienced team at Landmark Law has a proven track record of successfully resolving NRST objections on behalf of our clients. We will thoroughly analyze the objections, develop a strategic plan, and skillfully advocate for your interests, ensuring the best possible outcome.

Why Choose Landmark Law for Your NRST Needs?

Expertise and Experience: Our legal professionals have a deep understanding of NRST legislation and a wealth of experience in handling NRST rebates and objections. We stay up to date with the latest changes in the law to provide you with accurate and reliable advice.

Personalized Approach: We recognize that each client's situation is unique. That's why we take the time to listen, understand your circumstances, and tailor our services to meet your specific needs. You can trust us to provide customized solutions that align with your goals.

Diligence and Commitment: At Landmark Law, we are dedicated to providing exceptional client service. We pride ourselves on our meticulous attention to detail, thorough research, and unwavering commitment to protecting your rights and interests.

Timely and Efficient: We understand that NRST matters often require a prompt resolution. Our team is adept at working efficiently to meet deadlines and deliver results in a timely manner, ensuring that your NRST rebate or objection process progresses smoothly.

Take the First Step Today

Don't let the complexities of NRST rebates and objections hinder your financial goals. Contact Landmark Law to schedule a consultation with our knowledgeable team. We will assess your situation, explain your options, and guide you through the NRST process with confidence. Trust us to be your legal partner in securing your NRST rebate and overcoming objections effectively.

If you are a non-resident of Canada and purchased a real estate property that you paid Non-Resident Speculation Taxes (NRST) on and later applied to the Ministry of Finance for a rebate but was denied, the following next steps are available to you:

- Notice of Objection: A Notice of Objection is filed when your rebate for your NRST gets denied. The steps include completing and submitting a Notice of Objection to the Director, Advisory, Objections, Appeals and Services Branch at the Ministry of Finance. You must file this within 180 days of receiving the Statement of Disallowance.

- Notice of Appeal: If your Notice of Objection gets denied, the next option is to go to court and file a Notice of Appeal. You must file this within 90 days of receiving the Ministry of Finance’s decision on the Notice of Objection, with both the Superior Court of Justice and the Objections and Appeals Branch at the Ministry of Finance.

If you would like help with applying for your NRST rebate or objecting to or appealing a decision by the Ministry of Finance, Landmark Law would be pleased to assist. Please book your free consultation at www.landmarklaw.ca/book.

Disclaimer: The above information is intended as general information and not to be read as legal advice. Please seek legal advice from qualified legal professionals.

NRST Podcasts

- Just a Minute - Podcast Episode 28: NRST + Notice of Objection

Just a Minute - Podcast Episode 29: NRST Recap + Notice of Appeal

Other NRST Articles

NRST Client Kits - Getting Started with Us

-

Purchase Pre-assessment of NRST Rebate Eligibility [Click Here]

-

Non-Resident Speculation Tax Rebate Application [Click Here]

Landmark Law NRST Video

Questions

If you have any questions please email and cc both mike@landmarklaw.ca and winnie@landmarklaw.ca Click Here to send us an Email!!!

海外買家税退稅計劃 Non-Resident Speculation Tax (NRST) Rebate Program - 2023更新

Just a Minute - Podcast Episode 24: Power of Attorneys Dispute Part 1